Navigating the intricacies of property tax in Turkey is essential for both local and international property owners. This guide provides a detailed overview of the Turkish property tax system in 2025, addressing key questions and offering insights into regulations, payment procedures, and exemptions. Whether you are a first-time buyer or a seasoned investor, understanding these obligations is crucial for a smooth and compliant property ownership experience.

Property tax in Turkey, known as “Emlak Vergisi,” is a significant source of revenue for local municipalities. This locally levied tax applies to immovable properties situated within municipal boundaries and plays a crucial role in funding local services and infrastructure. The primary legal framework governing property tax in Turkey is Property Tax Law No. 1319, which outlines the scope, rates, and procedures related to this fiscal obligation. For the fiscal year 2025, taxpayers should be aware of updates in the applicable tax rates and property valuation methodologies. The levy extends to various categories of immovable property, including buildings, lots, and land, each potentially subject to different tax rates and valuation rules. The distinct treatment of “lots” suggests a specific categorization within Turkish property law, potentially related to zoning or development status.

Any individual or entity that owns immovable property within the boundaries of a Turkish municipality is liable for property tax in Turkey. This includes owners of residential properties (such as apartments and villas), commercial properties, lots, and land. The obligation to pay annual property tax in Turkey rests with the registered owner of the property as of the beginning of the fiscal year.

Read more: How to Buy Property in Turkey in 2025

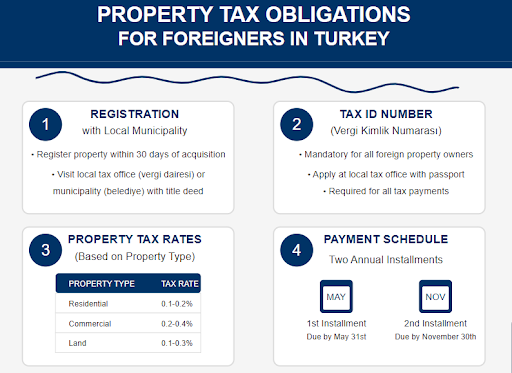

Yes, foreigners have to pay property tax in Turkey under the same regulations that apply to Turkish citizens. There is no distinction in the fundamental obligation to pay property tax in Turkey for foreigners who own property within Turkish municipal boundaries. Understanding the specifics of how property tax applies to foreigners is therefore crucial for international investors and homeowners.

Read more: Can Foreigners Buy Property in Turkey?

How property tax applies to foreigners in Turkey is largely the same as for Turkish citizens. Foreign property owners are subject to the same tax rates based on the type and location of their property. They are also required to adhere to the same valuation methods and payment schedules. Just like Turkish citizens, foreigners have to pay property tax in Turkey annually in two installments. Furthermore, property tax in Turkey for foreigners is also applicable to high-value residential properties exceeding a certain threshold, known as the Valuable Housing Tax.

Read more: Do You Pay Tourist Tax in Turkey?

The annual property tax in Turkey is payable each year in two installments. The specific rates for the annual property tax in Turkey vary depending on whether the property is located within a standard municipality or a metropolitan municipality.

Property Type | Standard Municipalities | Metropolitan Municipalities |

Residential Properties | 0.1% | 0.2% |

Commercial Properties | 0.2% | 0.4% |

Lots | 0.3% | 0.6% |

Land | 0.1% | 0.2% |

Vacant Land (for construction/farms) | 0.1% | 0.2% |

Note: Metropolitan municipality rates are generally double those of standard municipalities due to the higher level of services and infrastructure typically found in metropolitan areas.

The exact amount of property tax in Turkey depends on several factors:

For continuing taxpayers, the taxable value for 2025 is calculated by increasing the 2024 tax value by 21.965%. For new taxpayers in 2025, the valuation method involves cumulative increase rates from previous years to reflect the current real estate value more accurately. This multi-stage approach uses increase rates from 2022 (61.465%), 2023 (29.23%), and 2024 (21.965%) applied sequentially to the property’s initial value.

Read more: How Much Does It Cost to Buy a House in Turkey in 2025?

In addition to the standard annual property tax in Turkey, a Valuable Housing Tax (“Değerli Konut Vergisi”) is levied on high-value residential properties with an assessed value exceeding a specific threshold. For 2025, this threshold is reported as 15,709,000 Turkish Lira (TRY), although some sources mention 12.88 million TRY, indicating a potential need for official confirmation. The Valuable Housing Tax operates on a progressive rate system:

There are several convenient ways on how to pay property tax in Turkey:

It is essential to have the necessary property details and tax identification number readily available when making a payment.

The primary place to pay property tax in Turkey is the tax department of the local municipality where the property is located. For online or bank payments, the specific details will usually be provided by the municipality. The Title Deed Transfer Tax (“Tapu Harcı”), which is a one-time tax paid during property sales, is due at the General Directorate of Land Registry and Cadastre before the property ownership is officially transferred.

To pay annual property tax in Turkey, property owners should follow these steps:

The annual property tax in Turkey is paid in two installments: the first is due between March and May (deadline May 31st), and the second is due in November (deadline November 30th).

Failure to pay property tax in Turkey within the stipulated deadlines results in financial penalties. A late payment charge is applied to any delayed tax payments. As of May 21, 2024, the rate for this late payment charge was 4.5% per month of delay. The Turkish government has also announced increased tax penalties across various tax categories, effective from January 1, 2025, which could potentially mean more stringent consequences for late property tax in Turkey payments. Continued failure to pay can lead to further legal and financial repercussions.

Turkish property tax in Turkey regulations include provisions for exemptions and reductions for certain categories of individuals and properties. General exemptions may be available to individuals with no income, retirees, veterans, spouses and children of martyrs, and disabled persons. These exemptions often come with specific conditions, such as not owning another property, the property size being under 200 square meters, and the property serving as the permanent residence of the applicant. Retirees are generally required to be residing in Turkey to claim this exemption. To apply for these exemptions, eligible individuals typically need to submit an application to the municipality where the property is located, along with supporting documents like a petition, ID photocopy, title deed copy, and proof of income status. Residential properties owned by state institutions, municipalities, universities, and the Housing Development Administration may also be exempt, as may properties designated as cultural or historical heritage.

Read more: Where to Buy Property in Turkey?

Category of Individuals/Properties | Key Conditions for Exemption |

Individuals with no income | Typically requires proof of no income and the property being their sole residence. |

Retirees | Generally requires residency in Turkey and not owning another property (size limits may apply). |

Veterans, spouses/children of martyrs | Requires official documentation and the property being their primary residence. |

Disabled persons | Requires proof of disability and the property being their primary residence. |

State institutions, municipalities, universities, etc. | Specific criteria related to the ownership and use of the property. |

Cultural/historical heritage sites | Official designation as a heritage site. |

Note: Eligibility for exemptions should always be confirmed with the local municipality, as specific conditions and documentation requirements may apply.

Understanding the property tax in Turkey system is vital for all property owners. By being aware of the rates, valuation methods, payment procedures, and potential exemptions, you can ensure compliance and manage your property ownership costs effectively.

Looking for your perfect property in Turkey or have questions about property tax in turkey? At Azpo Estate, we are here to guide you through every step of your property journey. Contact us today to explore our diverse listings and benefit from our expert advice!

© 2025. All rights reserved by Azpo.